What does Brexit mean for the logistics industry?

- Paul Pini

- Mar 8, 2021

- 2 min read

Updated: Apr 6, 2021

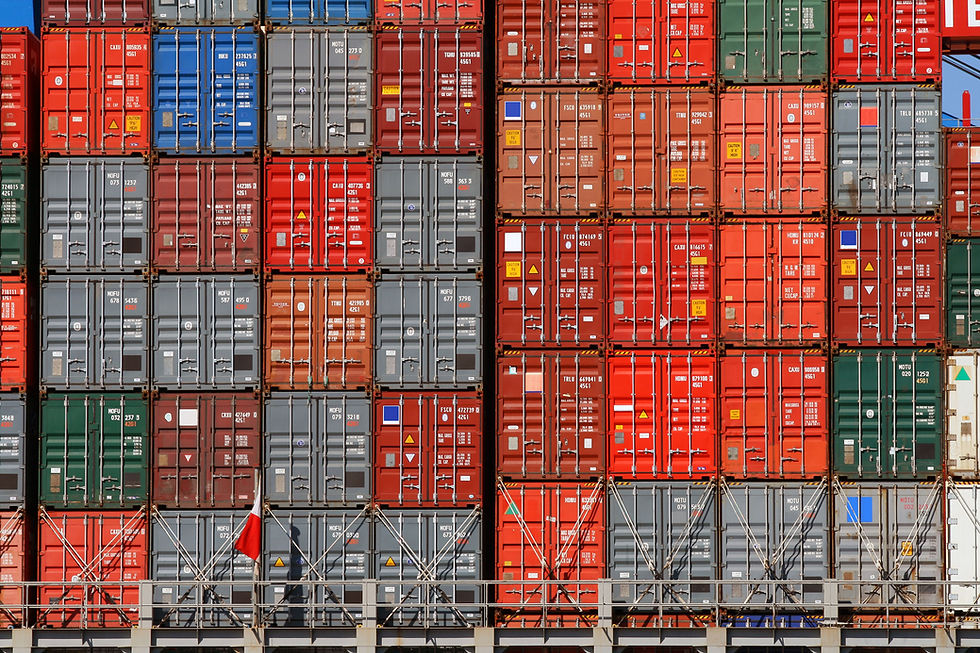

It doesn’t take a logistics expert to know that new trade agreements are going to change the business and logistics landscape… Not just in Europe, but across the globe! As with any change, this will present us with challenges, but also with opportunities. With the Covid 19 pandemic already presenting changes to the way we work, we are certainly no stranger to change. Here is what Brexit means for the logistics industry, based on what we know so far.

On 24th December 2020, the UK government signed a last minute agreement (known as a TCA) with the EU which approved the zero tariff and zero quota deal, which effectively safeguards consumers on both sides of the channel from billions in import tariffs on what we would consider everyday items. The TCA postpones some elements of the deal to be agreed at a later day, adding more mystery to the waiting game that has been the Brexit Trade Agreement.

We know that British Goods will still be liable to checks at border points, so you can expect this to add to your logistics bottom line as well as delivery times. The key element to overcoming this is preparation; knowing how custom declarations operate, considering additional checks for things like food and livestock as well as having a strong process for your paperwork will all play a key part here.

We would recommend a review of your systems and processes to ensure that everything is running as efficiently as possible to ensure your business’s logistics is not negatively impacted by Brexit and the extended delivery times. When completing your review, the key things to remember are:

You need to check if you must now pay duties on exports to the European Union. Under the new provision, any product or item(s) will be subject to a customs levy if it arrives in the UK from abroad and is then exported back into the EU.

As an exporter, you will require an EORI number (starting with the letters GB) to show that you are a recognised trader. Although most items will now have a 0% UK VAT rate, traders will have to pay an import VAT when the goods reach their destination.

UK companies selling to EU customers directly can send orders in individual parcels to the customer, either via the postal service or via a courier. However, retailers/wholesalers not sending individual packages will be required to submit declarations to pass through UK customs. Most businesses outsource this activity and use a logistics specialist to support their operations.

There is the potential that you will have to deal with SPS (sanitary and phytosanitary requirements).

Brexit stockpiling, covid 19 and seasonal changes have resulted in a shortage of warehouse space, if you are picking a freight company, investigate if they have storage facilities too. This will save you the headache, especially when you consider that it is predicted that by the end of 2021, there will be a need for an additional 30 million square feet of warehouse space!

If you need support with deciphering the TCA, or want to outsource to a specialist, then please get in touch.

Comments